What contributes a good or even great business?

There are definitely many ways to measure.

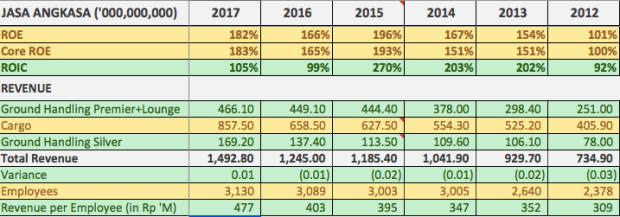

However, to me, the key is in ROE or better yet, ROIC.

By and large, Airlines businesses generate low ROIC or even minus.

Flying in the sky is tough.

Assets are huge and competitions are tight.

It is an almost perfect competition in work.

However, handling the airlines grounding is generally milder.

Be it passengers handling, cargo handling or owning airports.

There are regulations, licenses and oversights either by Government or Standardisation bodies.

To a city, Airport is generally monopoly or duopoly.

To an Airport, it is more effective to give license to mono or duo established Ground handlers based on fulfilment of strict criteria and also the more important factor of good track records.

The barrier of entry of such ground handling businesses is much higher.

If Angkasa Pura I & II were ever listed, I would be eager to invest in them (of course with the right price).

Since they are currently not, I land my feet in Jasa Angkasa Semesta (JAS) via CASS.

Do not blindly trust me when I say JAS is a good, or rather, great business.

I am biased since I am vested.

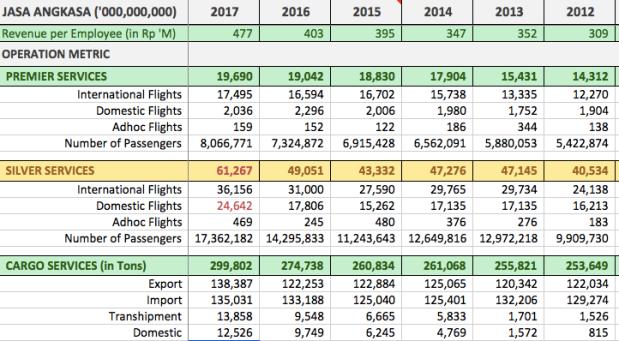

However, you may consult the numbers and come to your own conclusion.

Below for your food of thoughts or poison of mind (you pick!!) 🙂

As usual, even when the numbers are great, the risk is generally in human (yes, talking about you, Management, especially at parent level, yes you CASS).

Fall.Cushion_

Just for the fun of it I screened the entire IHSG against the Greenblatt metrics (Earnings Yield/Return on Capital) and CASS came out in the top 20, suggesting it was undervalued, however when you factor growth into the equation, it’s hard to be optimistic. EPS has grown less than 10% in the past two years (Rp. 57/share in 2015 > Rp.63/share in 2017). For me, it’s hard to justify CASS at PE 13x when BBRI trades at just 12x earnings.

LikeLike

on the former, i concur, the good business of CASS is only in JAS & JAE, other ventures are weighing badly on them. This is a case of good business with bad pilot!

I do not think a comparison of diff company in diff makes much sense or add much value.

However, if Bank capital is the oil to the economic machine, I’d think the Indo Banks is too inefficient with their high NIM (high cost to borrowers and low rate to depositors) and high opco and too high roe! It’s just like linches absording too much over indo.

Talk so much, in short, I don’t think Banks deserved to earn so much!

The disruption on the industry is super long overdued!

Lets hope blockchain can do something about it!

LikeLike